LCP Private Office, London’s leading residential buying and investment agency, issues its 2023 year review on the Prime Central London rental market., one of the leading property management companies in London, issues its Q3 2023 lettings report highlighting a resilient Prime Central London rental market.

PRIME LONDON LETTINGS REPORT: Q3 2023

LCP Private Office, London’s leading residential buying and investment agency, issues its Q3 2023 lettings report highlighting a resilient Prime Central London rental market.

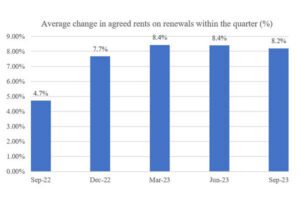

Competitive market conditions saw rents on renewals continue to rise higher than the rate of inflation and increasing to 8.2% in Q3. This is slightly below the previous Q2 and Q1 quarters at 8.4% but almost double Q3 2022 levels at 4.7%. Tenants are staying in their current accommodation; even at a markedly higher rent, rather than re-entering the rental market.

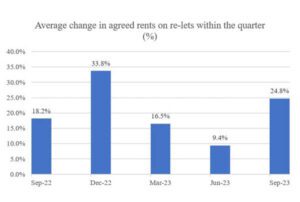

The return of students and corporate relocations looking for accommodation this autumn resulted in agreed rents on re-lets in Q3 rise by 24.8%. Scarcity of stock and a glut in demand ensured well priced properties received multiple offers. However, rent increases have not kept the same pace as the unseasonably busy Q4 2022, following the influx of tenants post pandemic.

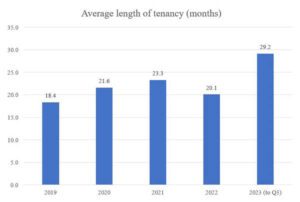

The average length of tenancy has now reached over 2 years, the highest level since 2012. This has been driven by competitive market conditions and higher rents, causing tenants to extend their current tenancies rather than risk significant rent increases on the open market.

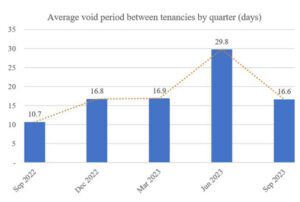

The time taken to let a vacant property stood at 16.6 days in Q3. This is higher than the 10.7 days seen in Q3 2022 when the rental market surged post-pandemic. Whilst voids are still below the pre-pandemic average of 27.3 days, this highlights the need for landlords to be realistic about their pricing to achieve a minimal vacant period between tenancies.

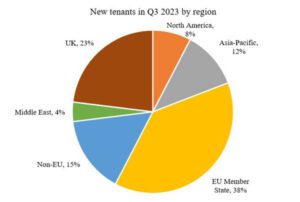

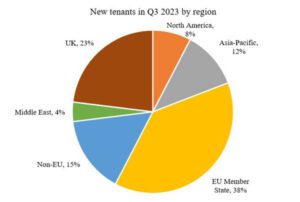

Q3 saw the return of overseas students and corporate relocations to London with only 23% of new tenants from the UK. Following the summer holiday months, tenants from the EU often represent the highest proportion of new tenants in Q3 and represented nearly 40% this quarter, in line with the same period in 2022.

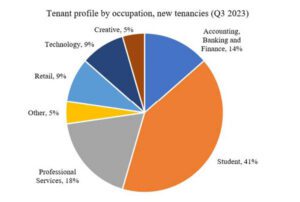

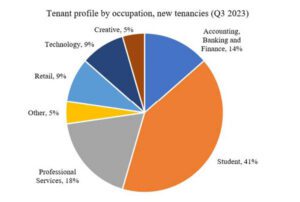

Students represented the highest proportion of new move-ins in Q3 at 41% as they return for the start of the academic year. Tenants working in the professional services and financial industries represented 32%. These tenants regularly rent in PCL due to their higher salaries and therefore are in a stronger position to afford higher levels of rent.

Liam Monaghan, Managing Director of LCP Private Office, comments on the market

Landlords continue to be in a strong position within the PCL rental market with rents running on average at 21% higher than pre-pandemic. Nevertheless even with these buoyant conditions, a well-planned pricing strategy is vital in the current market. Well-presented and priced rental properties continue to be snapped up by high-net-worth tenants. Landlords are also benefitting from the average length of tenancy reaching around 2 years, as tenants remain in their high-quality rental property than risk finding an alternative with a substantial rent increase.For many opportunistic investors, using little or no finance, these conditions make a rental investment look very attractive especially when motivated sellers in PCL are willing to sell at a discount. Nearly 50% of our current buyers are purchasing buy-to-lets within PCL.

Struggling to let your flat?

Get in touch to discuss your rental property and how we can help you find high-quality and reliable tenants.