LCP Private Office, London’s leading residential buying and investment agency, issues its 2023 year review on the Prime Central London rental market., London’s residential buying agency, issues its Q2 2023 lettings report highlighting a resilient Prime Central London rental market.

PRIME LONDON LETTINGS REPORT: Q2 2023

LCP Private Office, London’s leading residential buying and investment agency, issues its Q2 2023 lettings report highlighting a resilient Prime Central London rental market.

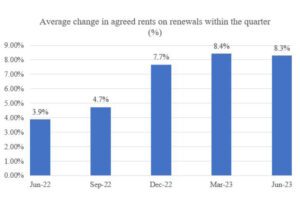

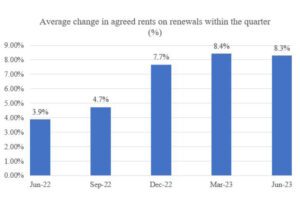

With the PCL rental market still seeing unprecedented demand, Q2 saw agreed rents on renewals increase by 8.3%. Similar levels were seen in the prior quarter at 8.4%. Increased competition, limited supply, and rising rents encouraged many tenants to renew their tenancy.

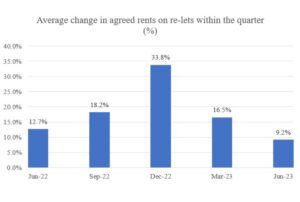

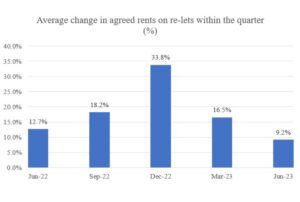

Despite Q2 being a quieter period, the need and desire to live in PCL has resulted in rent increases of 9.2%. This is on top of an increase of 12.7% in Q2 in the previous year. Rents are still outpacing the current rates of inflation.

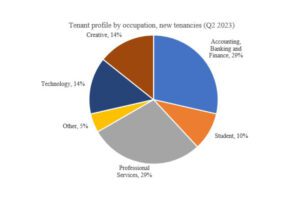

Tenants working in financial and professional services represented nearly 60% of our new move-ins. Tenants from the technology sector have seen significant growth now standing at 14% in Q2 2023 compared with only 3% in 2019. Tenants in the creative industries nearly tripled to 14% in 2023 compared with 5% in 2019.

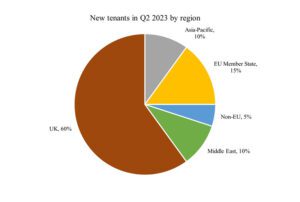

UK tenants represented the largest proportion of new move-ins at 60% and have tripled since Q2 2019 from 21%. We anticipate the usual influx of HNW students and young professionals from Asia-Pacific returning to Central London over the summer months and autumn.

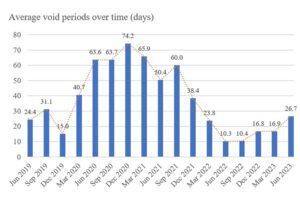

Within our managed portfolio, the time taken to let a vacant property has stabilised, reaching similar levels seen pre-pandemic. In Q2 2023, it took on average 26.7 days to let a vacant property and still stands below the pre-pandemic average of 27.3 days.

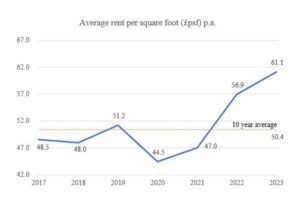

With the current supply and demand imbalance in the rental market, the average rent per square foot has exceeded the 10-year average of £50.4 per sq ft, standing at £61.1 per sq ft. This is mainly a result of increased competition and limited buy-to-let purchases during the pandemic.

Liam Monaghan, Managing Director of LCP Private Office, comments on the market

Notwithstanding current economic factors at play, the PCL rental market is proving resilient and rents continue to rise above inflation as demand continues to outstrip supply.

A limited number of buy-to-let transactions during the pandemic has restricted the replenishment of the rental market which can be seen with the average rent per sq ft in PCL standing at £61.1, 21% over the 10-year average.

The lettings market is often a leading indicator of the direction of travel for the sales market and with the continuing buoyant rental market and travel no longer restricted, buyers are anticipated to return.

For investors with cash or low levels of finance, looking to start or add to their portfolio, attractive opportunities are currently available before the market starts to accelerate.

Struggling to let your flat?

Get in touch to discuss your rental property and how we can help you find high-quality and reliable tenants.