Property Search

Learn More

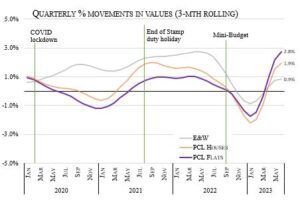

PCL outperformed Greater London and England & Wales for the last 3 months.

Price growth & volume of sales (3-mth rolling)

Liam Monaghan, Managing Director of LCP, comments on Prime Central London

More positive signs continue for the apartments market in Prime Central London (PCL) as flats outperform houses in PCL and England and Wales in general for the last month and quarter. PCL flats now stand on average at £1,175,326. The PCL market, including both flats and houses, outperformed Greater London and England & Wales for the last 3 months. Despite PCL properties coming with a premium price tag, the market correction during the pandemic has led to more favourable pricing and therefore renewed interest from both UK and international buyers. The domestic market in England and Wales is now seeing the detrimental impact of over inflation and high interest rates.

Despite the uncertain economic market, PCL is somewhat immune to the impacts of the interest rate hikes and rising cost of living. Nevertheless a disconnect between what sellers are willing to sell for and what buyers are prepared to pay mean transactions continue to stall. Demand for apartments is currently driven by first-time buyers with the financial support of ‘Bank of Mum and Dad’ and buyers purchasing in cash or with little finance. As we head into the summer holiday months, we expect activity levels to drop but anticipate a busy Autumn as overseas buyers return to London for the start of the academic year.

A return to city living and the financial pressure on the domestic market has resulted in the divergence between England and Wales and PCL to widen. Since February 2023 PCL flats and houses have experienced an upward price growth trajectory whilst the consistent interest rate hikes in an overheated domestic market caused it to plateau. With borrowers coming to the end of their fixed interest terms, we expect activity and price growth to slow further or even reduce in England and Wales.

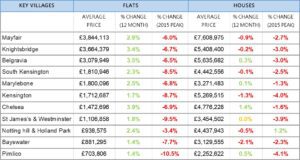

Prime Central London Performance By ‘Village’ and by property type

In the last year, apartments have outperformed houses in all PCL villages bordering Hyde Park. Pimlico and Bayswater saw the smallest yearly growth at 1.4%, whilst Chelsea saw the strongest annual growth of 3.9%. Apartments in Pimlico offer significant discounts of up to nearly 11% when comparing against the 2015 peak. In the house market, Chelsea saw the strongest annual growth of 1.4% whilst Bayswater saw a 2% decline. Only houses in Notting Hill and Holland Park have surpassed their 2015 peak values.

Looking at our latest data, we are only in a “buyer’s market” if buyers know how to identify the right properties. By conducting thorough research and engaging with a professional company like LCP, can you really benefit from the great growth and returns potential in PCL.

London Central Portfolio is more than just a buying agent. We help clients acquire, renovate, design, let or manage their property in Prime Central London. Whatever your ask, we are here to help. To arrange a call with one of our search experts, please click here.