Property Search

Learn More

The PCL apartment market outperformed Greater London and England & Wales for the last 3 months and year.

Price growth in PCL, Greater London & England and Wales (3-mth rolling)

Liam Monaghan, Managing Director of LCP Private Office, comments on Prime Central London

Despite the summer holidays, a seasonally quieter period in the real estate market, the apartment market in Prime Central London (PCL) outperformed houses in PCL, Greater London and England and Wales for the last 3 months and year. PCL flats now stand on average at £1,172,770. The PCL market, including both flats and houses, outperformed Greater London and England & Wales over the last quarter. This increased activity in PCL can mainly be attributed to the return of overseas buyers, mainly from Asia and the Middle East, who often travel to the UK over the summer months. As expected, the domestic market in Greater London and England and Wales continues to be impacted by higher mortgage and inflation rates with negative growth over the last 12 months.

For cash buyers, it is an ideal time to invest as the Autumn market is already showing higher numbers of properties coming to the market. Within that, there will be a pool of motivated sellers (as their fixed term mortgages come up for renewal) who are more likely to accept a lower offer. It is worth noting that PCL flat prices, whilst now rising ahead of the rest of the market are still 8% below their peak in 2015. There are definitely ‘deals’ to be had but the issue is timing. As we enter a busy time in the real estate market, there will be more demand for well-priced properties which often leads to bidding wars and in turn price increases.

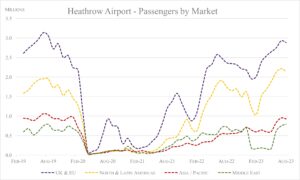

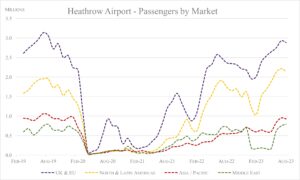

Heathrow traffic from all key regions have reached pre-pandemic levels. The increased air travel from Asia-Pacific and the Middle East in particular, can be seen as an important and leading factor facilitating the recovery of the PCL market, especially the apartment market.

We expect air travel to continue to rise as we enter the busy Autumn market, a popular time for overseas to visit the UK for the milder climate and the start of the school term. 60% of our current search clients are based in Asia-Pacific.

Prime Central London Performance By ‘Village’ and by property type

In the apartment market, PCL villages popular with overseas buyers saw the strongest annual growth – Knightsbridge (2.1%), South Kensington (1.9%) and Belgravia (1.8%). Only Kensington and Bayswater saw marginal negative annual growth at – 0.3% and – 0.6% respectively, highlighting a small window of opportunity to purchase prime property at a discount. Pimlico continues to be positioned as a good investment location with only marginal growth over the last 12 months and substantial discounts when comparing against the 2015 peak (-11.8%).

There are opportunities to be had within the PCL house market as all villages bordering Hyde Park saw negative annual growth, with Bayswater (-3%), Kensington (-2.7%) and Mayfair (-2.7%) seeing the biggest decline in the last 12 months following a fairly strong price surge during the pandemic driven by the “race for space.” Flats on the other hand are benefiting from a move back to city living.

LCP Private Office is more than just a buying agent. We help clients acquire, renovate, design, let or manage their property in Prime Central London. Whatever your ask, we are here to help. To arrange a call with one of our search experts, please click here.