Property Search

Learn More

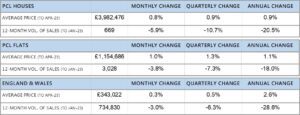

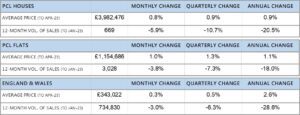

Price growth & volume of sales (3-mth rolling)

Liam Monaghan, Managing Director of LCP, comments on Prime Central London

The apartments market in Prime Central London (PCL) appears to be showing signs of a come-back recording the highest monthly price growth in almost a decade of 1.0%, outpacing monthly growth of 0.8% for houses. This recovery, off the back of the disastrous mini-budget in September where the PCL housing market saw 4 consecutive months of decline, has resulted in average price of apartments now standing at £1,154,686, 1.1% up against the same time last year. This however is still 8.0% below the 2015 peak showing opportunity yet still to be had for the prospective apartment buyer. House prices on the other hand have now exceeded their previous 2015 peak by 0.3%.

Though the housing market overall still looks to be subdued with ONS data showing stamp duty receipts for England and Northern Ireland falling from £1.5bn to £1.1bn in March – a 24% drop compared to the same time last year, anecdotally, the number of properties for sale in PCL is slowly increasing as sellers adapt to market conditions. With a busy spring market forecasted for PCL, our data points towards buyer priorities shifting back to central London apartment living with the domestic buyers continuing to capitalise on apartment discounts before the full return of overseas investors. Furthermore, the competitive rental market will continue to fuel the demand from first-time buyers of 1 to 2 bedroom flats with the help of the Bank of Mum and Dad.

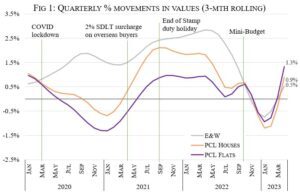

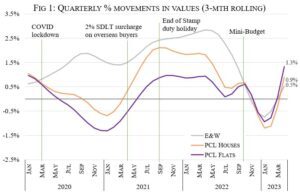

It is clear to see the divergence of price growth between flats and houses in PCL versus England & Wales since March 2020 (see Fig 1). The pandemic race for space accompanied by the stamp duty holiday between July 2020 to September 2021 and the low interest rate environment, encouraged many to move who perhaps would not have otherwise and sent values soaring across the UK. Within PCL, houses were preferred for the lifestyle needs of home buyers, whilst the absence of investors and the local workforce during Covid has meant flats have taken longer to return to pre-Covid levels. However, this month marks the first time flats in PCL have clearly outperformed both sectors and have marginally narrowed the 18-month long pricing gap (March 2020—September 2022). Whether it is demand from city workers who have returned to their offices most of the week and prefer to be living in London rather than commuting from the countryside, the return of overseas investors or indications that mortgage rates and inflation may potentially ease off boosting investor confidence — these are all encouraging signs for the local prime apartment market.

Best performing villages in Prime Central London by property type

Within Prime Central London, the villages listed above have fared better against the overall 12-month average % change of PCL (1.1% for apartments and 0.9% for houses). The table also shows that although apartments have not recovered as much as houses since the 2015 peak, in certain villages like Mayfair, Knightsbridge and Kensington, apartments have shown considerably more growth in the last 12 months than houses. The best performing villages have been Knightsbridge and South Kensington for flats and St James’s & Westminster for houses.

London Central Portfolio is more than just a buying agent. We help clients acquire, renovate, design, let or manage their property in Prime Central London. Whatever your ask, we are here to help. To arrange a call with one of our search experts, please click here.