Property Search

Learn More

The UK property market in 2023 experienced a subdued performance with limited discernible movement, though not as bad as previously anticipated.

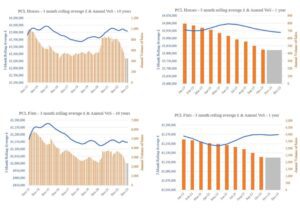

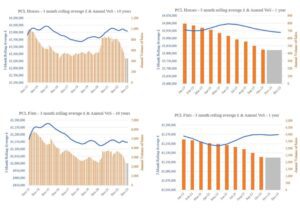

Price growth & Volume of Sales in PCL, Greater London & England and Wales (3-mth rolling)

Liam Monaghan, Managing Director of LCP Private Office, comments on Prime Central London

The UK property market in 2023 experienced a subdued performance with limited discernible movement, though not as bad as previously anticipated. The overarching theme underpinning the year was the disconnect between buyers’ appetite and sellers’ expectations which resulted in a cap on transaction volumes and static price growth. In the year to October 23, the PCL market saw only 2,830 transactions equating to just 54 a week and 34.8% below the 12-months prior. It was not just PCL that suffered from low transactional activity with England & Wales experiencing only 9,542 transactions a week, a 42.2% drop from the same time the prior year. High inflation and interest rate rises prompted many buyers to delay their property purchases and for tenants to stay put within the rental market. The core apartment market within PCL grew slower than anticipated, as adverse economic conditions and global events deterred overseas buyers who remained cautious, waiting for an opportune time to invest.

PCL, Greater London and England & Wales all saw static price growth on an annual basis with PCL faring slightly better with values only falling by 0.3% whilst England & Wales experienced a 1.3% fall.

With interest rates and inflation reducing, 2024 heralds some much-needed confidence to buyer sentiment. These new market conditions should bring some movement back into the market. This, combined with PCL flat prices at 10.2% below the 2015 peak, creates a favourable time to buy. 2024 will see a general election, predicted to be within the second half of the year. As usual we will expect to see a drop in activity a few months prior, but history has shown that almost immediately after the result has been announced, there is a rush in activity as the electoral uncertainty passes. Unlike the last election, the prospect of a Labour government is unlikely to be a major dampener on buyer sentiment.

Prime Central London Performance By ‘Village’ and by property type

There are still deals to be had within PCL, as all villages bordering Hyde Park saw marginal negative annual growth across both flats and houses. Only the flat market in Kensington and Notting Hill & Holland Park saw any annual growth at 0.1% and 1.0% respectively. Both villages are popular with high-net-worth individuals and families.

All PCL villages are still showing attractive discounts from the 2015 peak. Flats in South Kensington and Pimlico, in particular, are showing very favourable discounts of up to 14.3%. Houses in Knightsbridge and Chelsea have seen the biggest discount from peak at 8.3% and 8.1% respectively.

For investors and first-time buyers, looking to take advantage of the current market, flats in Pimlico are looking appealing with average prices standing at around £691,195 a 14% discount from peak. Pimlico’s prime location, architecture and transport links have made it a popular destination for homeowners as well as investors.

LCP Private Office is more than just a buying agent. We help clients acquire, renovate, design, let and manage their property in Prime Central London. Whatever your ask, we are here to help. To arrange a call with one of our search experts, please click here.