LCP Private Office, London’s leading residential buying and investment agency, issues its 2023 year review on the Prime Central London rental market, London’s leading residential buying and investment agency, issues its 2023 year review on the Prime Central London rental market.

PRIME LONDON LETTINGS REPORT: 2023 YEAR REVIEW

LCP Private Office, London’s leading residential buying and investment agency, issues its 2023 year review on the Prime Central London rental market.

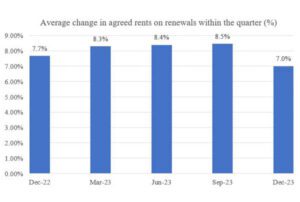

Significant tenant demand has continued to result in landlords negotiating favourable renewal increases. With a shortage of rental stock and increased competition, tenants chose to renew at an increased rent on their renewal rather than re-enter a competitive market. Q4 saw a renewal increase of 7%, showing signs of the market returning to normal conditions.

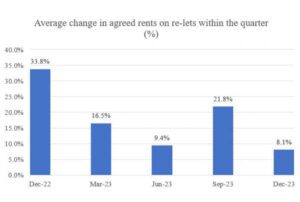

Despite Q4 seasonally being a quieter period in the rental market, rents on re-lets still rose by 8.1% and in excess of inflation figures. With both inflation and interest rates stabilising, more tenants could be in a better position to buy this year, easing the demands on the rental market in 2024.

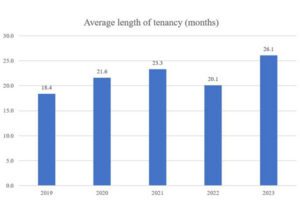

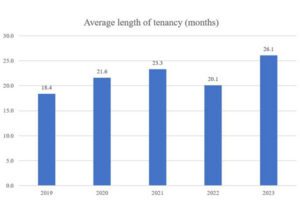

The average length of tenancy in 2023 reached 26.1 months, the highest level on record. Competitive market conditions caused tenants to either extend their current tenancies and stay put at a higher rent, or offer landlords a longer tenancy to secure a property. Whether 2024 will maintain these levels is yet to be seen and will depend on the level of supply in the market.

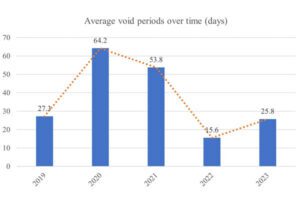

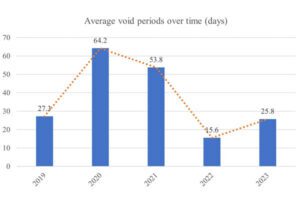

The PCL rental market showed signs of stability in 2023 after a period of unprecedented demand in the previous year. The average time a property stood vacant was 25.8 days in 2023, in line with the pre-Covid average of 27.3 days. Landlords still need to be realistic about their pricing to reduce vacant periods between tenancies.

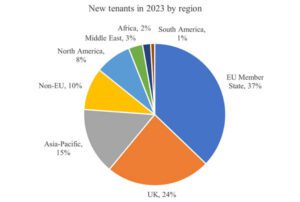

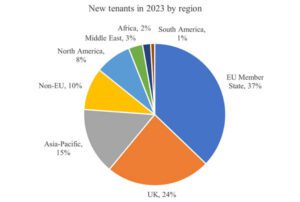

In 2023 the nationality of new tenants from the EU and UK rose to 61% compared with 51% prior year. Of that, tenants from the EU represented the largest proportion of new tenants at 37% and increased by nearly 10% from the previous year. The largest number of tenants outside of the EU and UK were from Asia-Pacific at 15% in 2023.

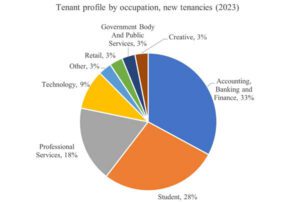

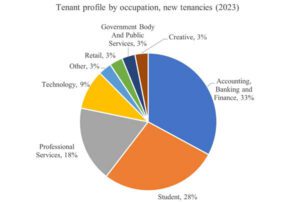

2023 saw a diverse range of occupations amongst tenants. The financial sector continued to represent the highest number of new tenants at 33%, a 5% increase from prior year. This ongoing trend may be a result of high earning professionals being in a stronger position to afford the high levels of rent in PCL. HNW students represented the second largest proportion of new tenants at 28%.

Liam Monaghan, Managing Director of LCP Private Office, comments on the market

2023 showed signs of the PCL rental market dynamics becoming more stable and in line with inflation, with rents on new tenancies in Q4 softening to 8.1% and renewals standing at 7%. However, competitive market conditions and the ongoing supply and demand imbalance led to the average length of tenancies in 2023 reaching 26.1 months, being the highest level in LCP’s records. Whether these levels continue throughout 2024 remains to be seen but it does highlight the need for landlords to secure high-quality tenants, alongside a well-implemented and planned pricing strategy to remain competitive.

With recent announcements of the mortgage market beginning to settle down in the UK, there could be a turn from renting to buying property, which will bring some much-needed stimulation to the sales market. With the general election predicted to take place in the second half of the year and with good value opportunities remaining on the market over the Christmas period, now could appear to be the opportune time to invest.

Struggling to let your flat?

Get in touch to discuss your rental property and how we can help you find high-quality and reliable tenants.