Property Search

Learn More

An unseasonably quiet Autumn resulted in PCL, Greater London and England & Wales showing generally static price growth on a monthly and quarterly basis.

Price growth & Volume of Sales in PCL, Greater London & England and Wales (3-mth rolling)

Liam Monaghan, Managing Director of LCP Private Office, comments on Prime Central London

An unseasonably quiet Autumn in the residential market resulted in PCL, Greater London and England & Wales showing generally static price growth on a monthly and quarterly basis as well as early indicators of transactions continuing to slide. Notably, year-on-year, PCL pricing continued to show a marginal degree of resilience (-0.5%) and fared slightly better than Greater London (-1.3%) and England & Wales (-1.4%) which are directly impacted by local domestic and economic factors.

The apartment market in PCL marginally outperformed houses in PCL, Greater London and England & Wales over the last year. PCL flats now stand on average at £1,154,697, -0.3% below this time prior year. PCL house values stand at £3,866,664 -1.8% below last year. It should be noted that PCL flat prices are still -9.1% below their 2015 peak, whilst houses have shown a far greater recovery, suggesting a significant bounce back for flats in the future is still probable. The average price across England and Wales is £297,221, -1.4% below last year following significant rises during the pandemic.

The real estate market is in flux at the moment and pricing can currently make or break a sale. The disconnect between what buyers are wanting to pay and what sellers are willing to accept continues to impact transaction volumes and ultimately price growth. With 80% of PCL property held mortgage free and much of the remainder with a moderate level of finance, there is a limited pool of options available for buyers to ‘bag’ a bargain. Reduced transaction volumes demonstrate that sellers are willing to hold onto their assets for a more favourable market. Over the 12 months to August 2023 there have been only 3,368 transactions in PCL, a fall of 20.6% over the previous year. Those who are buying are either cash buyers or motivated to move themselves, the rest are adopting a ‘wait and see’ approach.

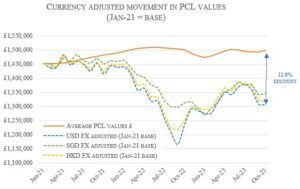

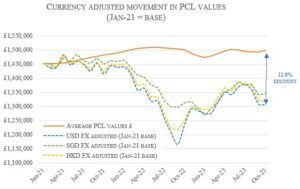

Good news for dollar-denominated buyers as the current exchange rate presents a favourable opportunity for those looking to enter the property market. Along with generally suppressed pricing in the PCL flats market, buyers purchasing in US dollars will also be benefitting from a secondary discount of up to nearly 13%.

Prime Central London Performance By ‘Village’ and by property type

Across both the flats and houses markets, all PCL villages are showing discounts from the 2015 peak. Pimlico in particular is showing great opportunities with substantial discounts of -13.5% for apartments and -8.4% for houses.

In the apartment market, PCL villages popular with HNWs and overseas buyers saw the strongest annual growth – South Kensington (1.8%), Knightsbridge (1.6%) and Mayfair (1.4%), albeit at marginal levels. St James’s and Westminster and Pimlico saw the largest negative annual growth at -1.5% and -1.6% respectively, highlighting a window of opportunity to purchase prime property at a discount.

There are opportunities to be had within the PCL house market as almost all villages bordering Hyde Park saw negative annual growth, with Bayswater (-3.1%) seeing the biggest decline. Only South Kensington and Chelsea saw marginal positive annual growth at 0.3%. Both markets are popular with HNW families.

LCP Private Office is more than just a buying agent. We help clients acquire, renovate, design, let or manage their property in Prime Central London. Whatever your ask, we are here to help. To arrange a call with one of our search experts, please click here.